Featured

Table of Contents

Photo Are registered in the California Alternating Prices for Energy (CARE) or Family Electric Rate Aid (FERA) program. Have made at the very least one on-time repayment in the previous 24 months.

Consumers that sign up in the AMP program are not eligible for installment plans. Web Power Metering (NEM), Direct Access (DA), and master metered consumers are not presently qualified. For consumers intending on moving within the following 60 days, please apply to AMP after you've developed service at your brand-new move-in address.

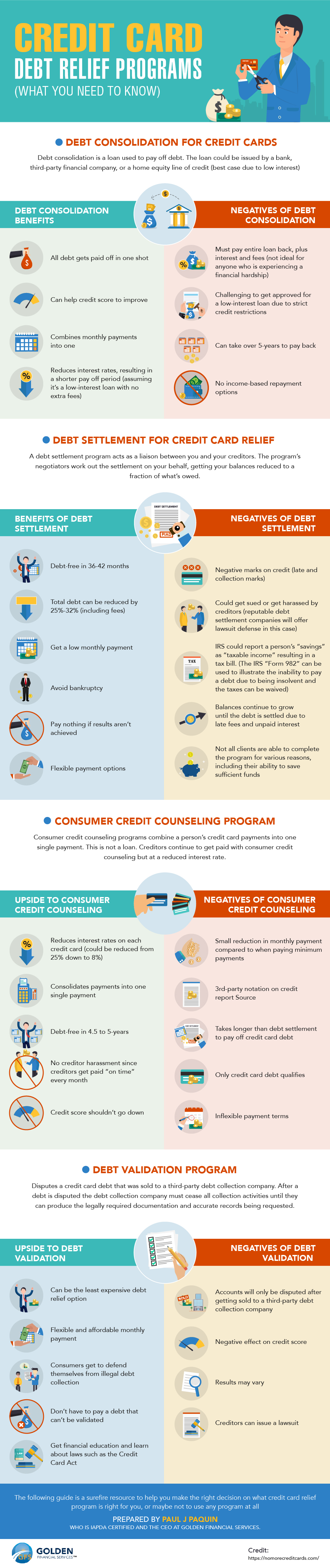

The catch is that nonprofit Credit score Card Debt Mercy isn't for everyone. InCharge Debt Solutions is one of them.

The Debt Card Forgiveness Program is for people who are so far behind on credit scores card repayments that they are in serious economic difficulty, perhaps dealing with insolvency, and don't have the revenue to capture up."The program is especially developed to help clients whose accounts have actually been charged off," Mostafa Imakhchachen, consumer treatment expert at InCharge Financial debt Solutions, stated.

7 Easy Facts About What to Understand During the Bankruptcy Experience Described

Creditors that participate have actually concurred with the nonprofit credit rating therapy agency to accept 50%-60% of what is owed in fixed monthly payments over 36 months. The set settlements indicate you know exactly how much you'll pay over the repayment period. No interest is billed on the equilibriums during the payoff duration, so the payments and amount owed do not alter.

It does reveal you're taking an energetic role in minimizing your financial obligation., your debt rating was currently taking a hit.

The counselor will review your financial resources with you to establish if the program is the right option. The testimonial will include a look at your monthly income and costs. The company will pull a credit history report to recognize what you owe and the level of your challenge. If the forgiveness program is the very best solution, the counselor will certainly send you an arrangement that details the strategy, consisting of the quantity of the monthly repayment.

If you miss out on a repayment, the arrangement is nullified, and you should exit the program. If you think it's an excellent alternative for you, call a counselor at a not-for-profit credit score counseling firm like InCharge Financial obligation Solutions, that can address your questions and assist you establish if you certify.

What Does Recession That Affect How More Americans Need for Practical Advice for Speaking With Creditors & Improving Payment Terms Mean?

Due to the fact that the program enables consumers to choose much less than what they owe, the creditors that participate want reassurance that those that take advantage of it would not have the ability to pay the sum total. Your charge card accounts also must be from banks and charge card business that have actually concurred to get involved.

Balance needs to go to the very least $1,000.Agreed-the balance needs to be repaid in 36 months. There are no extensions. If you miss out on a settlement that's just one missed payment the arrangement is terminated. Your creditor(s) will cancel the strategy and your balance goes back to the initial quantity, minus what you have actually paid while in the program.

With the forgiveness program, the financial institution can instead pick to maintain your financial debt on the publications and redeem 50%-60% of what they are owed. Nonprofit Debt Card Debt Forgiveness and for-profit debt negotiation are similar because they both offer a way to settle bank card debt by paying less than what is owed.

Not known Factual Statements About Recovering Personal Financial Standing the Smart Way

Bank card mercy is designed to cost the consumer much less, repay the financial obligation quicker, and have less drawbacks than its for-profit equivalent. Some crucial areas of difference in between Credit Card Financial obligation Mercy and for-profit financial obligation negotiation are: Bank card Financial debt Mercy programs have connections with lenders that have concurred to get involved.

Once they do, the payback period begins immediately. For-profit financial debt negotiation programs negotiate with each creditor, usually over a 2-3-year duration, while rate of interest, charges and calls from financial obligation collectors proceed. This means a larger appeal your debt report and credit report rating, and an enhancing equilibrium till negotiation is finished.

Credit History Card Debt Forgiveness clients make 36 equivalent regular monthly settlements to remove their financial debt. The repayments go to the financial institutions till the agreed-to equilibrium is eliminated. No interest is billed during that period. For-profit debt negotiation clients pay into an escrow account over an arrangement period toward a swelling amount that will be paid to financial institutions.

Table of Contents

Latest Posts

Some Known Details About Recession Impacting Rising Need Are Seeking Debt Forgiveness

The 8-Minute Rule for Staying Safe Against Unethical Companies

The 3-Minute Rule for Steps You Can Take to Restore Your Life

More

Latest Posts

Some Known Details About Recession Impacting Rising Need Are Seeking Debt Forgiveness

The 8-Minute Rule for Staying Safe Against Unethical Companies

The 3-Minute Rule for Steps You Can Take to Restore Your Life